Trading Forex Gaps

Gaps In The Forex Market Admiral Markets

Trading the gap: what are gaps & how to trade them?.

Understanding Gaps In The Forex Market Blackwell Global

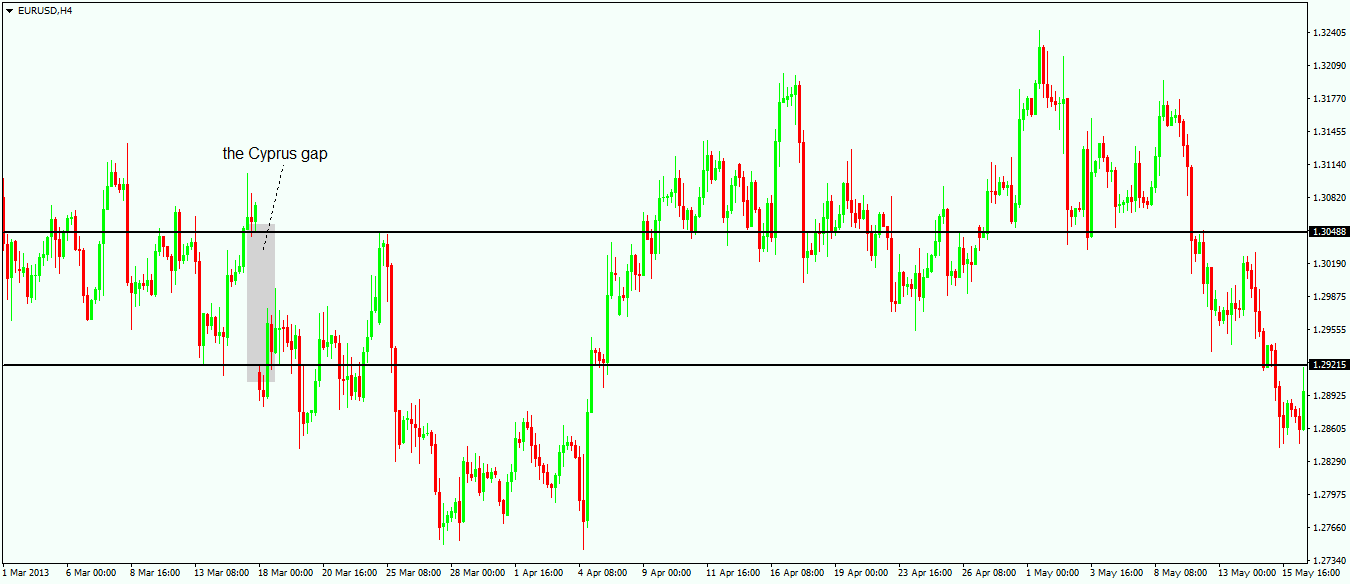

Trading the gaps in the forex market may prove to be a profitable undertaking if the currency pairs have a relatively high level of volatility. however, there are no guarantees that the gaps will be filled and therefore, trading the gaps should be done with caution. June 14, 2017 14:46 gaps are common in the forex market because trading usually only occurs between set market hours depending on which forex trading is being conducted. the forex market is active 24/5 for retail traders, but the interbank market operates 24/7. this particular time difference is where the gaps might show up. Gaps refer to areas on a chart where the price of a currency or stock moves sharply up or down with little or no trading in between. as this area represents an abnormality in the normal price pattern of the stock/instrument, it gets referred to as a gap. Gaps can be important in trading because there is a widely held belief among traders that gaps are usually filled quite quickly, which provides an opportunity for forex traders to make a likely profit, because the most likely short-term trading forex gaps direction of the price can be successfully predicted.

Forex Gap Trading Strategies That Really Work In 2020

Gap: a gap is a break between prices on a chart that occurs when the price of a stock makes a sharp move up or down with no trading occurring in between. gaps can be created by factors such as.

Trading forex at the weekend gaps is a growing field of investment. forex weekend trading hours have extended away the traditional trading week. forex trading the trading forex gaps weekend gaps are becoming popular because of trader’s expecting sunday’s opening price to return to friday’s closing price. there is a mistake that you can’t trade over the. Gaps can be especially exciting in the forex market, where it is not uncommon for a report to generate so much buzz that it widens the bid and ask spread to a point where a significant gap can be seen. similarly, a stock breaking a new high in the current session may open higher in the next session, thus gapping up for technical reasons.

Playing The Gap Investopedia

Trading the gap: gap trading strategies & tips. there are a range of gap trading techniques to explore, from fading and predicting gaps to using indicators to help you gauge price action. fading. The forex gap trading strategy is an interesting price action trading system that is based on a phenomenon known as the forex gap. this gap trading strategy is based on the daily timeframe and you don’t need any forex indicators for this. if you don’t know what a forex gap is, i will also explain it here. what is a forex gap? a forex gap happens when the opening price of candlestick is not the same as the close of the previous candlestick.

Forexgaptrading can be a profitable trading strategy, if you know what you are doing. in this post, i will explore the definition of a gap and hopefully get you to increase your awareness of them. the purpose of this post is not to teach you one way to trade it and say that is the only way. Thank a lot of your lesson of forex gap. i just understanding well about the gap trading from your lesson. during the covit-19 crisis, there are forex big gaps that makes me loss on trading because i misunderstanding its process of closing gap. i will apply your lesson for next forex gap. A gap is easily recognized on a price chart; it appears whe 92% of traders lose their hard earned money following other peoples tips or calls but little did they know that by learning how to trade correctly and understanding the mannerisms of other traders they could be the 8%. Thus, it is recommended to avoid trading gaps within a range and without additional confluence factors. the other 3 types of gaps usually provide higher probability trading opportunities. the gap-fill. the gap-fill is a popular trading strategy and it is used not only in the stock market, but also in forex.

Gaps are spaces on a chart that emerge when the price of the financial instrument significantly changes with little or no trading in-between. gaps occur unexpectedly as the perceived value of the. Charts typically only appear at the start of a new trading session (or in forex, a new trading week). therefore, trading the gaps will require patience to watch the behavior of the candles after. The forex weekend trading strategy trading forex gaps that capitalises on gaps is about anticipating sunday’s opening price will have returned to friday’s closing price. the ‘gap’ is simply the price differential between the price when the traditional forex market closes on a friday evening, and the price when it reopens on a sunday.

strategy: forex strategy "return" forex strategy "return to gap" forex strategy "big dog + fibo" trading strategy triangles forex strategy "flag + abc" forex strategy « The forex gap trading strategy is an interesting price action trading system that is based on a phenomenon known as the forex gap.. this gap trading strategy is based on the daily timeframe and you don’t need any forex indicators for this. if you don’t know what a forex gap is, i will also explain it here. Gaps can occur in both the upward and downward direction. unlike the stock markets, the forex market operates 24 hours a day, 5 days a week. it is usually during the weekend that such gaps can be seen. when the market opens on monday, it is seen that prices have jumped up or down, from the closing price on friday. Forexgaps blackwell global forex broker the empty spaces between the close of one candle and the open of the next are called forex gaps. these are sharp price breaks, with no trading in between.

Weekend gap trading is a popular strategy with foreign exchange, or forex, traders. while technically open around the clock, forex trading closes on friday afternoon and doesn’t reopen until sunday. Gaps are sharp breaks in price with no trading occurring in between. gaps can happen moving up or moving down. in the forex market, gaps primarily occur over the weekend because it is the only time the forex market closes. gaps may also occur on very short timeframes such as a one-minute chart or immediately following a major news announcement.

14mil in 30 days course long candle forex course magic momentum course magic moving average course grid trading course mt4 charting skills course set & forget eas divergence trader makemoney ea the weekend gap ea the powerpunch ea magic moving average ea The four types of gaps in trading aside from gap down and gap up, there are four main types of gap, dependent on where they show up on a chart: common gaps, breakway gaps, continuation or runaway. Gaptrading example. to tie these ideas together, let's look at a basic gap trading system developed for the forex market. this system uses gaps to predict retracements to a prior price. here are.

Weekend gap trading is a popular strategy with foreign exchange, or forex, traders. while technically open around the clock, forex trading closes on friday afternoon and doesn’t reopen until. Gaps are common in the forex market because trading usually only occurs between set market hours depending on which forex trading is being conducted. the forex market is active 24/5 for retail traders, but the interbank market operates 24/7. this particular time difference is where the gaps might show up. Gap trading conclusion. gaps, in the forex market are a common phenomenon and depending on the type of gap that was identified, long or short positions can be taken. if you are not sure about trading with gaps, gaps can alternatively be used as a confirmation signal. for example, when you notice a runaway gap being formed, you can take a.

0 Response to "Trading Forex Gaps"

Post a Comment